Managing one’s patrimony is arbitrating between various assets on the basis of yield, liquidity, risks or time horizon. But there is one category getting very low attention : cash.

Cash for asset-sellers (real estate, stock, fixed income, financial product managers or seller) is the pocket in which they wish to dig to get a commission for selling.

Cash for individuals is their freedom to act or to protect, and is felt as the solid rock, immune to loss of value. Unfortunately, it is not the case. Putting aside the problems of ownership, discussed in other posts, if the face value of your cash does not vary, the purchasing power (the amount of freedom attached) is largely inconstant. And there is the well-documented problem of inflation. But on top of that, your cash is stored in currencies that vary constantly in relation to other currencies, so your purchasing power in other monetary zones may be altered.

And this is not only a problem for so-called weak currencies. A small example, worth no more than an illustration :

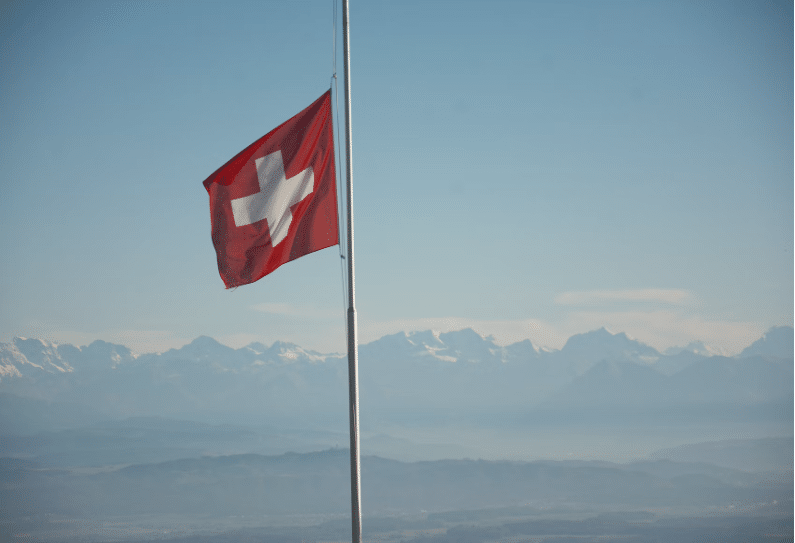

At the end of 2014, a friend of mine, a Swiss resident, but having earned his patrimony in the eurozone thanks to the sale of his company, decided to buy a small residential building for investment purposes. Having spotted a nice lot for 6M CHF around Christmas, he decided from a common agreement with the seller to close the deal beginning 2015. On the 15th of January, The Banque National Suisse decided, without any warning, to let the CHF float, so it jumped from 1.2CHF/euro to 1.02CHF/euro. Immediately, the building cost the buyer 6M€ instead of 5M€. “He should have covered his change rate risk” will shout some financial experts! “But the BNS had held the CHF/euro rate at the same level for years” will answer most of the others !

“You never know” is what most of us will remember from this little story. That is why, at TAL, we have decided to offer to all the possibility to store everyone’s cash value in a stablefiat, thanks to our basket, to protect your purchasing power even in other monetary zones, because “you never know”.